Social Security Contribution a new, unified, flat rate contribution

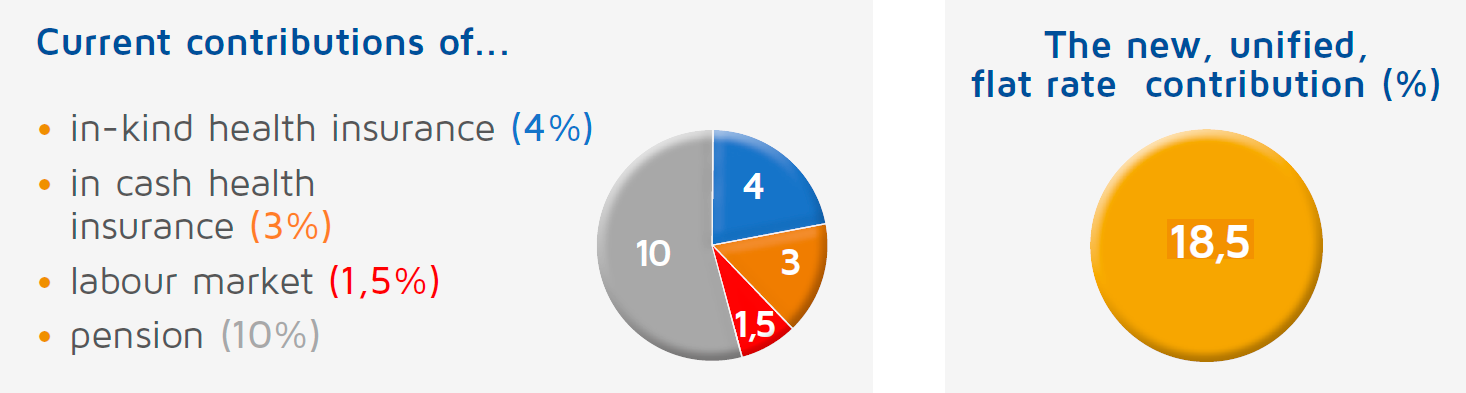

Combining the current health insurance cash and in-kind, labour market and pension contributions, the new Act creates a flat-rate social security contribution, at an unchanged summed-up rate of 18.5%. –

In case of legal relationships which so far were not subject to the 1,5% labour market contribution (such as engagement contracts) from now on a contribution of 18,5% shall be paid, so in these cases the amount of the contribution payable by the individuals will increase.

The family contribution allowance can now be claimed on the entire 18.5% social security contribution by those who are eligible to do so. (Until now the allowance could not be claimed on the 1.5% labour market contribution).

Minimum threshold for contribution payments

For individuals working in an employment relationship a minimum threshold for contribution payment will be introduced: the minimum contribution base of social security payment shall be at least 30% of the minimum wage, even if the monthly income of the employee is less than this, with the provision that if in the course of the month

- the employee’s employment relationship is established or terminated,

- the employee’s insurance is suspended,

- the employee receives sickness allowance, benefits for accident-related injuries or maternity allowance,

then these calendar days are to be disregarded in calculating the minimum threshold of contribution. In such cases one thirtieth of the monthly contribution base should be calculated for each calendar day.

Thus, the monthly amount of the minimum payable social security contribution, calculating with the currently applicable minimum wage, is:

161 000 × 0,3 = 48 300 × 0,185 = 8 936 HUF

The minimum threshold for contribution shall not be applied if the employee:

- receives child care benefit, child care assistance benefit, child raising benefit, child home care benefit, adoption allowance or nursing allowance;

- is a student pursuing full-time course of study in a public education institution or within the framework of full-time education arrangement, person pursuing studies under the Act on Vocational Training in a vocational training institution in the framework of full-time vocational education, and students attending institutions of higher education under the Act on the National Higher Education System pursuing full-time course of study.

The employer is obliged to assess and pay the social security contribution payable by the insured employee even if it is not possible to deduct it from the income paid in the actual month. In this case employer shall record the advanced contribution amount as a receivable from the insured person.

Pension contribution as a separate contribution

Pension contribution remains also as a separate contribution. Only the 10% pension contribution shall be paid by the following individuals:

- beneficiaries of child care benefit, child care assistance benefit, child raising benefit, child home care benefit, nursing allowance;

- beneficiaries of health impairment benefit;

- beneficiaries of job seeker’s allowance;

- members of social cooperatives working in the frame of member’s work relationship.

Facilitations concerning pensioners on own right

In all legal relationships (e.g. engagement agreement, entrepreneurs) listed in 6. § of the new Social Security Act (so not only in case of employment relations under the Labour Code), pensioners on their own right shall be released from the payment of contributions and therefore Personal Income Tax shall be their only payment obligation.

The employer or payer will not be obliged to pay social and training fund contribution.

Changes in healthcare service contributions

By an ex officio procedure, starting within 8 days after receiving the declaration (e.g. employer declares that its employee will be on unpaid leave), the tax authority automatically calculates the healthcare service contribution payment obligation. The procedure starting by the registration of the natural person with the tax authority will be exceptional. If any private individual’s arrears of healthcare service contribution exceeds the triple of the monthly contribution amount, his social security identification card (TAJ-card) will be invalidated and he will be disclosed from the free of charge healthcare services subsidized by state social security system.

Changes concerning associated entrepreneurs

As of 1 July 2020, the minimum payable taxes and contributions of associated entrepreneurs will be as follows:

- social contribution – its base shall be 112,5% of the minimum wage or guaranteed wage minimum,

- vocational training contribution – its base shall be 112,5% of the minimum wage or guaranteed wage minimum,

- social security contribution – its base shall be 100% of the minimum wage or guaranteed wage minimum,

- PIT (personal income tax) – payable only regarding the entrepreneurial withdrawal, so if there is no withdrawal, no personal income tax payment obligation exists.

You can download our newsletter in English here:

SME-INFO-Nr2020-12-New-Act-CXXII-of-2019-On-Social-Security-in-Hungary.pdf

The version in Hungarian is available here:

SME-INFO-Nr2020-12-CXXII-2019_Uj-tarsadalom-biztositasi-torveny.pdf

The purpose of SME INFO is to provide general information and to draw the attention to the current changes in law which we believe to be important for the business operation of our clients. It is not a replacement for careful review of the acts and rules and the consultation with your tax advisor.

© Copyrights 2020, Process Solutions – All rights reserved